Understanding the Importance of Crypto Security

Significance of Securing Your Crypto Assets

Cryptocurrencies are digital assets that exist on blockchain networks. As decentralized digital money, it is the user’s responsibility to safeguard their cryptocurrencies. Without adequate security measures, crypto assets can be stolen by hackers or lost due to carelessness. Establishing robust security protocols is essential to protecting your investment.

Risks Associated with Inadequate Security Measures

The biggest risk is outright theft of crypto assets from your account or wallet by hackers. There have also been many cases of investors losing access to crypto holdings due to lost private keys or forgotten passwords. Accidental transfers to wrong addresses can also result in asset loss. Without proper backup mechanisms, hardware failure or data loss can permanently destroy access to cryptocurrencies.

Assessing Your Current Security Posture

Conducting a Security Audit of Your Crypto Holdings

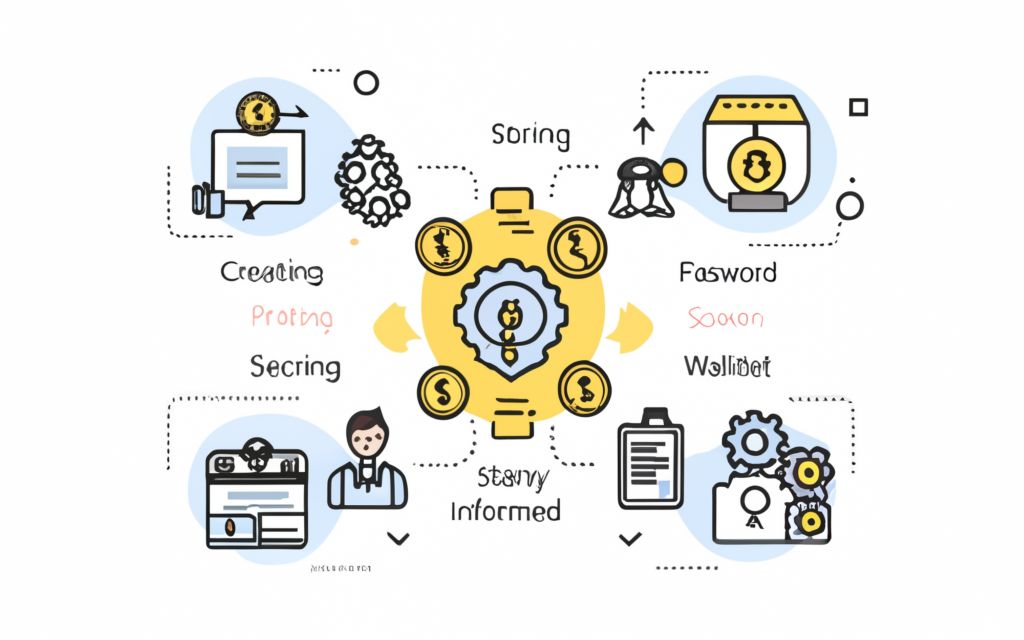

Before making any major investments, it is wise to conduct an audit of the security practices you already have in place. This will reveal any vulnerabilities or gaps in security that can then be addressed. A crypto security audit involves reviewing your wallet and exchange account safeguards, auditing passwords and recovery phrases, inspecting connected devices, and ensuring you have backup mechanisms enabled.

Identifying Vulnerabilities and Weak Points

The security audit may uncover aspects like reused passwords across accounts, outdated software versions, lack of multi-factor authentication, and insufficient encryption. Such lapses significantly weaken your crypto defense measures. The audit will help classify vulnerabilities into high, medium and low risk categories so they can be tackled accordingly.

Establishing a Strong Foundation: Creating Secure Passwords and Keys

Guidelines for Generating Complex and Unique Passwords

Unique passwords with maximum complexity should be created for all crypto-related accounts. An effective password combines upper and lower case letters, numbers, and symbols while being at least 12 characters long. Using a password manager can help generate and store strong passwords for each account. Do not reuse the same password across multiple accounts.

Importance of Safeguarding Private Keys

Private keys are essentially the passwords that allow access to cryptocurrencies on a blockchain network. Anyone who gains access to the private key can assume control of the assets. Hence it is absolutely vital to store private keys securely – either by encrypting and storing digitally or keeping physically offline in cold storage. Avoid sharing or storing private keys improperly where they are visible or can be discovered through hacking.

Table: Comparison of Popular Two-Factor Authentication (2FA) Apps

| App Name | Compatibility | Features | User Ratings |

| Authy | Cross-platform | Token replacement | 4.6 / 5 |

| Google Authenticator | Mobile devices | Timer sync codes | 4.5 / 5 |

| Duo | iOS and Android | Device agnostic codes | 4.7 / 5 |

| LastPass Authenticator | Cross-platform | Encrypted backup | 4.1 / 5 |

Choosing the Right Wallet: Understanding Different Types and Security Features

Hardware Wallets vs. Software Wallets: Pros and Cons

Hardware wallets leverage encrypted physical drives to completely isolate secret keys offline, offering enhanced security. However, they can be costlier. Software wallets are free and convenient but vulnerable to hacking since they remain connected online. Most experts recommend using both wallet types to balance security with practicality.

Factors to Consider When Selecting a Wallet

The main aspects are anonymity, backup features, transparency, types of coins supported, ease of access to funds, connectivity options, and security protocols like two-factor authentication and transaction validation. Your choice also depends on tech proficiency and level of crypto holdings.

Securing Your Transactions: Best Practices for Safe Trading and Transfers

Verifying Addresses and Double Checking Transactions

Before initiating any transfer, rigorously cross-check that you have the right recipient address – misdirected crypto transactions are irrecoverable. Similarly, always review transaction details as a final confirmation before submitting transfer orders. Following these principles can help avoid costly mistakes.

Using Secure Communication Channels for Transactions

When communicating any transaction details or wallet addresses, use encrypted messaging platforms like Signal rather than SMS or non-encrypted email. This will prevent interceptions that can lead to theft attempts during the transfer process.

Implementing Multi-Layered Security Measures: Encryption, Firewalls, and More

Utilizing Encryption for Data Protection

Enabling encryption security features in wallets and on devices used to access your cryptocurrency will put vital data like private keys behind a protective barrier that prevents unauthorized access. Encryption converts data into coded form that cannot be understood by external parties.

Setting Up Firewalls and Intrusion Detection Systems

Network-based protections like firewalls and solutions like anti-virus software and system updates will provide general security enhancement. Intrusion detection technology can also be implemented to monitor systems and detect potential threats before a full breach occurs.

Developing a Response Plan: Preparing for Security Incidents

Creating an Incident Response Team and Protocol

Having an established plan for security incidents can hugely mitigate breaches and issues when they do arise. Develop an emergency response manual mapping out contingency measures. Maintain an updated list of contacts like wallet providers or exchanges who will need to be notified in case of a hack. Enable account recovery features.

Regularly Testing Incident Response Plans

Simply formulating a response plan is not enough; running through mock breach scenarios will reveal gaps and areas of improvement for your protocols. Schedule periodic tests – especially when changes occur to your crypto infrastructure. Review and update emergency protocols so you remain prepared.

Educating Yourself and Staying Informed: Building a Culture of Crypto Security

Continuous Learning on Latest Security Trends

The crypto landscape evolves rapidly. Subscribe to thought leader updates, certification courses, crypto security blogs, etc. to educate yourself on new wallet standards, encryption techniques, hacking tactics,

changes to blockchain protocols, and other trends. Ongoing learning is essential.

Sharing Knowledge Within the Crypto Community

Engage actively on industry forums, attend events and share security tips or insights with peers. Being an informed part of the crypto community facilitates more robust security practices. Maintain dialogue with users, developers, analysts, and other stakeholders to stay updated.

Encouraging Responsible Practices Among Peers

If we each play our part in championing good security habits within our networks, overall ecosystem safety improves. Set a personal example – and politely encourage contacts to adopt two-factor authentication, use hardware wallets, learn about phishing techniques, etc. A rising tide lifts all boats – so expanding security-first conduct makes cryptocurrency stability stronger.

Conclusion

Implementing robust crypto security measures can seem intimidating initially. However, following the practical building blocks covered across tools, technologies, policies, and community engagement practices discussed here will ensure your holdings remain protected against both digital and human risks. Making security a priority from day one prevents the headache – and potential portfolio losses – from incidents later. As crypto adoption advances, keep parallel focus on fortifying your defenses.

FAQs

Q1. How do hardware wallets compare to software wallets? Hardware wallets leverage encrypted physical drives to offer enhanced offline security isolation for private keys. Software wallets provide more flexibility and connectivity but are prone to online hacking risks. Using both balances security with practical access.

Q2. What are some common crypto security mistakes? Common errors include reusing passwords across accounts, lacking backups of private keys/recovery phrases, disabling two-factor authentication, sharing sensitive wallet data, and neglecting software updates. Avoiding these missteps makes breaches preventable.

Q3. How can I create strong passwords? Effective passwords combine upper and lower case letters, numbers and symbols while having at least 12 characters in length. Using a password manager facilitates unique and complex credentials for every account.

Q4. What is the importance of encryption? Encrypting wallet data, devices and communication channels puts sensitive information like private keys behind a protective barrier that prevents unauthorized access, even if systems are breached.

Q5. Why is it important to have an incident response plan? Having an established incident response plan hugely mitigates damage and speeds resolution if a hack does occur. Knowing who to contact, which steps to take, and how to recover accounts will make navigating a breach easier.

Q6. How can I stay updated on crypto security trends? Actively engage with industry forums, subscribe to thought leader updates, take certification courses, follow crypto security blogs, etc. to educate yourself on the latest developments and threats.

Q7. What is a healthy community best practice regarding crypto security? Setting a personal example of security-first habits and politely encouraging peers to adopt protective measures like multi-factor authentication and offline storage solutions. A shared culture of security improves ecosystem stability.

Stephen Shaw is a leading expert on the use of non-fungible tokens (NFTs). He has worked extensively with blockchain developers and entrepreneurs to create new ways to use NFTs.

Stephen’s work has led him to become a sought-after speaker and advisor on the topic of NFTs. He has spoken at events around the world, and his advice has been sought by startups and major corporations alike.

Stephen is passionate about using NFTs to create new economies and opportunities for people all over the world. He believes that NFTs have the potential to change the way we interact with each other and with our possessions.